Green Energy Makes Business Sense

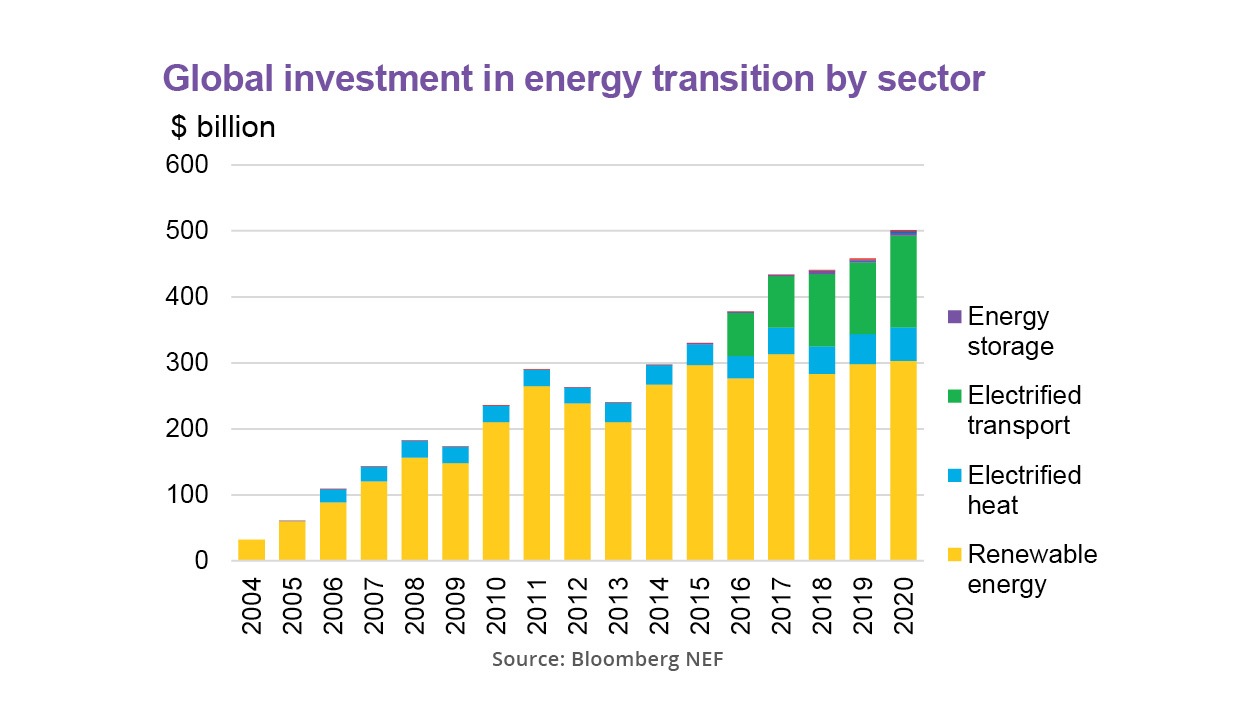

• Venture funds are joining the rush to renewable energy—and it’s not a passing fad• Government subsidies will help, but innovative companies and business logic will drive growth From the frozen electric grids of Texas to the tar-soiled beaches of Israel, the urgent need to transform our dependance on fossil fuels is becoming clear. You don’t have to be a tree-hugging naturalist to embrace the shift. Even the world’s largest oil producers have begun a strategic pivot toward renewables. In 2016, the Saudi government announced its Vision 2030 which it said aimed to end the kingdom’s “addiction” to oil and diversify its economy and energy sources. Venture investment in renewables has soared as global investment in energy transition more than doubled from $235 billion in 2010 to $501 billion in 2020, according to Bloomberg NEF. In 2019, venture and private equity investment in cleantech was estimated between $9 and $16 billion, up from less than $500 million in 2013. Global oil companies like Shell, BP, Total and Repsol are investing unprecedented amounts to develop new solar, wind and other...

Read More