Every year, more brick-and-mortar stores close their doors for the final time. Malls and department stores, once a mainstay of American suburbia, are struggling in the age of online shopping. Even well-established brands like Toys “R” Us and Sears are not immune to these trends, both declaring bankruptcy in 2018.

The decline doesn’t seem to be letting up in 2019, with retailers shutting down 23% more stores than they did at the start of last year (2000+ store closings), according to Coresight Research.

Even stores that have weathered the storm thus far are showing bleak numbers. JC Penney closed 139 stores in 2017, despite aggressive efforts to woo Sephora customers and Sears refugees. Macy’s, its better-faring competitor, is moving away from physical storefronts, cutting its square footage by 13% between 2015 and 2018. Grocery chains like Family Dollar, whose premise of cheap goods was considered “Amazon proof,” has announced the closure of 390 stores in 2019 despite an $8.5B buyout by Dollar Tree.

And yet, American consumers are buying at a dizzying pace. E-commerce is booming, with online shopping accounting for $517.4B of spending with US merchants in 2018. Directto-consumer brands are are skipping store shelves and heading straight to the doors of customers. Amazon, which accounted for 40% of last year’s US online retail, continues to capture ever more of the market.

With e-commerce representing nearly 15% of retail sales and rising, and the nature of consumers changing, it is time to ask: what is the future of retail? There are several trends emerging that may give some insights into where the market is heading.

“Born Global” to “Born Online”

Several highly successful companies that were born online are opening brick-and-mortar stores. Millennial-leaning leaders like Rent the Runway, Glossier, and Casper are opening storefronts in dense urban areas, designed to be used as a branding tool as much as a revenue generator.

In 1993, McKinsey Quarterly used the term “born global” to define a business whose focus is international from inception and predicted this model would define how companies conduct business in the future. Today’s digital e-commerce successes aren’t merely developing strategies to expand beyond borders as quickly as possible – they are a new generation of firms that are “born online” and later build out physical spaces as they grow.

Casper, an OurCrowd portfolio company and new addition to the class of 2019 $1B “unicorns,” is a prime example of this new generation of “born onlines.” Casper is a directto-consumer sleep brand that broke onto the scene in 2014 with a re-designed, high quality mattress that shipped directly to consumers’ doors. After their initial online success, the company set out to strengthen its brand by re-defining the in-store mattress shopping experience, cutting out aggressive sales tactics and instead creating a branded wellness experience. While incumbent competitor Mattress Firm began a process of consolidation and subsequently filed for bankruptcy in 2018, Casper announced it would be opening 200 retail locations across the US. Customers can even spend $25 to visit Casper’s nap destination, The Dreamery, to enjoy a 45-minute branded snooze.

Other born-online companies include Warby Parker, Bonobos, Everlane and Allbirds. Buyers now expect stores to offer an opportunity to connect with a brand in a way that is relational rather than purely transactional. “A big part of this is building a community of people that value sleep and want to share that with us,” says Casper SVP of Experience Eleanor Morgan.

Customers can spend $25 to visit Casper’s nap destination, The Dreamery, to enjoy a 45-minute branded snooze.

A Frictionless User Experience (UX)

Friction — defined as excessive clicking and difficulty at checkout — is a main contributor to consumer drop-off and has become a central issue for retail companies.

“Everything we do needs to be done for the customer to remove friction,” said ASOS’s Chief Information Officer Cliff Cohen in a 2018 Wired interview. “Whether that means integrating Google Pay or working with startups to develop technologies we don’t have the capacity to work on ourselves.”

Friction accounted for a shocking two-thirds of drop offs in smartphone purchases, according to a recent report by Facebook and KPMG. Retailers are thus racing to reduce friction by removing as many barriers as possible to checkout. According to bigcommerce.com, companies will lean more heavily on headless commerce, which separates the front and back-ends of e-commerce platforms, making changes to the platform smoother and resulting in a better checkout experience.

A 2018 PYMNTS.com study found that $200B in sales have been lost annually due to checkout friction. Reducing time to checkout, which sits at around 2.65 minutes according to the same study, could contribute to a major uptick in sales.

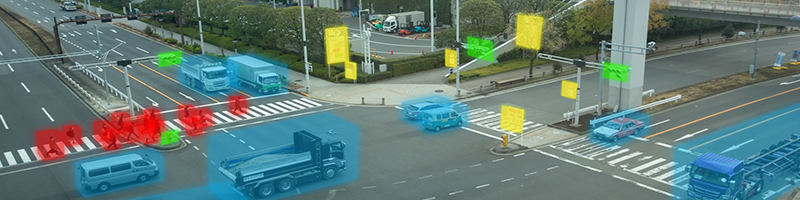

Physical stores are also being re-vamped to reduce friction. Once more, Amazon is one of the leaders. It opened its first instant-checkout Amazon Go brick-and-mortar store in Seattle in 2018. Amazon Go allows customers to scan their smartphones at entry and simply leave with their items, thanks to the store’s “Just Walkout Technology.”

Several of OurCrowd’s portfolio companies are also deeply involved in reducing friction and optimizing the in-store experience. CB4, for example, has developed machine learning software that enables retail chains to solve operational issues that hamper sales. Portfolio company Ubimo uses location data to extract insights to capitalize on critical purchasing decision points– by providing consumers with the right offer at exactly the right time. On the mobile front, OurCrowd’s Neura is also working hard to improve in-app shopping experiences by better segmenting and targeting customers. The company’s AI platform integrates real-world behavior such as time spent traveling and working, physical activity level, and even commuting schedule, allowing brands to deliver relevant, customized interactions to drive customer engagement and retention.

Sustainability and Transparency

In addition to aggressively studying consumer behavior, retailers are looking to attract customers through meaningful company interactions. The conscious consumer, armed with seemingly unlimited information, is taking a serious interest in the sourcing and ethics of products. Sustainability is no longer a fringe endeavor for those wanting to save the planet— it is a growing part of retail strategy.

Technology is the key to the transition to sustainability. In balancing price with environmentalism, companies need to find technology that will tip the scales in their favor, be it with insight into which designs are most likely to sell, thereby keeping waste down and profit high, or with new forms of 3D technology reducing lead times to prototypes.

Acting more and more as individuals, companies are being asked to take a stand on social issues, including environmental ones, which have proven to be particularly important to millennials. Many successful “born online” companies have created sustainable and conscious brands with an emphasis on transparency, making them memorable to an increasingly aware market.

OurCrowd portfolio company The Bouqs knows this to be true and has disrupted the $100B global floral industry by emphasizing sustainability and transparency. Traditionally, flowers are shipped from South American farms to US importers, then wholesalers, then florists, and finally consumers in a labyrinthine supply chain. Between 30% and 50% of stems are wasted before the product reaches the end customer. Recognizing this, The Bouqs CEO John Tabis cut out the middlemen and deployed technology directly at farms to shorten the supply chain and ensure that fair labor practices are followed, rainwater is recycled, and red label chemicals are not used.

This focus on sustainability and transparency has paid off; since its inception, The Bouqs has grown at a compound annual growth rate (CAGR) of 130%, with 50-60% of its business coming from repeat buyers. These conscious retail companies give customers a reason to come back beyond the economic transaction. Customers and investors are increasingly supporting businesses with this kind of mission, committing their dollars to companies working toward making the world a better place.

This is an excerpt from OurCrowd’s Q2 Innovation Insider, download it here.

About the Author

Friederike Kaiser, Associate, Portfolio Management