Rights Offerings

A Rights Offering is an issuance of ‘Rights’ to a company’s existing shareholders that allows them to purchase additional shares from the company in proportion to their ownership, within a fixed time period. In a Rights Offering, the issue price of each share is generally at a discount to the current market price.

The Good

Companies will often seek a Rights Offering when they need to raise money quickly (for example, to service a debt covenant, pursue an aggressive acquisition or for general working capital requirements). From a company’s perspective, Rights Offerings are typically much quicker to close than a new equity issuance, and are much cheaper to execute. From an investor’s perspective, the subscription price of a Rights Offering is often-times at a significant discount to the company’s stock price, as it needs to be attractive enough to encourage all investors – including early investors – to participate with their prorata amount of the raise.

The Bad

Issuing stock at discounted valuations carries the risk of signaling a distressed cry to the market. Not only is the offering’s share price discounted, but by issuing additional shares, the inherent value of previous shares in the company are also diminished. For this reason, Rights Offerings are limited to existing investors only, in accordance with their prorata ownership of the company, such that the raise doesn’t cause undue dilution to investors. However, it should be noted that common shareholders/non-participating investors will generally be highly diluted in such circumstances.

The Complicated

With different investor cohorts sitting among different rounds in a company’s investment history, the Preference Stack leads to misaligned interests amongst these groups, and consequently different motives to participate in a Rights Offering.

To recall, a Preference Stack is the order of which capital is distributed to shareholders during a liquidation or sale. Typically, the investors in the latest round of financing demands a “LIFO – last in, first out” distribution structure, such that they get their capital out of the company before any other shareholders (down side protection). After this latest round’s investors are made whole, the next in line will receive their share, and so on and so forth until all preferred investors recoup their full invested capital. Thereafter, in the event that there remain residual assets to distribute, the common shareholders (founders, management, employees) will receive their piece.

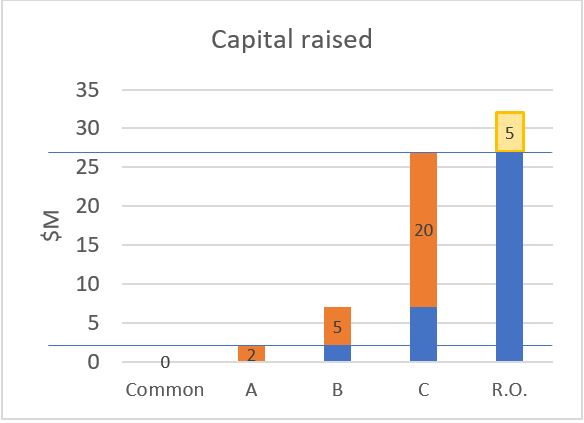

Let’s look at a simple example: a company raises $2M for Preferred A shares from Adam, $5M for Preferred B shares from Ben and $20M for Preferred C shares from Carl, such that the total capital raised is $27M. Now, contemplating a $5M Rights Offering, the company needs to determine deal economics that are equally attractive to Adam as they are to Carl. But, based on our discussion on Preferences, Carl knows that so long as the company exits for at least $25M, he will be made whole on his Series C investment, whereas Adam needs to hold out until an exit of $32M. Adam may feel legitimately frustrated by having to pony up additional capital for Carl’s benefit. In order to encourage Adam’s participation in the Rights Offering, the existing Preference Stack is typically waived with a new Preference Stack created going forward, such that Adam, Ben and Carl will all be on an even playing ground for distributable assets (on a prorata basis of the total of their accumulated invested capital across all rounds, i.e. $27M in our example). Of course, Carl’s interest is to have the Preference Stack remain alive and well, but he realizes that waiving his rights may be the only way to give the company the cash infusion that its seeking.

Summary

Although Rights Offerings may appear draconian in ‘sticker price’ valuation, realizing that participation in such offerings result in retention of your ownership percentage of the underlying company, which is now well fueled for growth, should be an important decision point.